The investment would demonstrate Silicon Valley’s affection for “free-thinking, high-spending startup founders,” it said. Also: New crypto guidelines in the US and Amazon feels “bullied”.

Good morning! While you slept, work continued elsewhere in the digital scene.

The top topics:

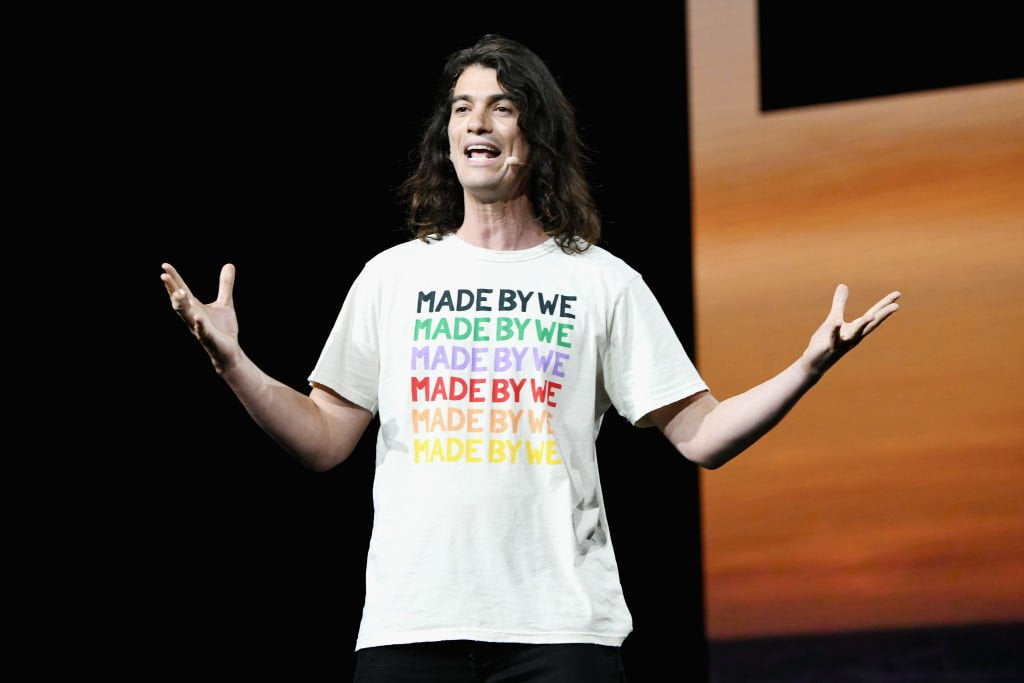

Several US media have questioned why a founder like Adam Neumann despite his saga at the office space broker Wework again receives millions for a new startup. His project called Flow gets backing from the prominent venture capital firm Andreessen Horowitz. The investment is also not a small sum: According to the “New York Times”, the approximately 350 million US dollars is the largest check ever issued for a single financing round in the history of the fund. The rental project Flow has not even started yet.

The “huge new venture capital investment” shows that “Silicon Valley’s affection for free-thinking, high-spending startup founders persists, even in a bear market,” Axios said. And further: “Neumann’s comeback shows that the people who direct tech capital still believe that the most valuable resources in the industry are entrepreneurial experience and epic audacity.” The tech medium “Techcrunch” also criticized the investment: “The News puts reality in a harsh light,” the outlet wrote. Some founders are weary of tackling the “concrete ceiling” where gender, race and socio-economic conditions create a discriminatory barrier. [Mehr bei Axios und Techcrunch]

on Founder Scene: At the beginning of 2020, the fitness startup released One M more than a fifth of its employees. The company’s valuation suffered in subsequent financing rounds. Today, things are going better than ever: Egym could even go public at the end of this year, the CEO hopes. Editor Lisa Ksienrzyk took a closer look at the Munich company. [Mehr bei Gründerszene+]

And here are the other headlines of the night:

cryptocurrencies: The US Federal Reserve (Fed) has issued guidelines on how banks should deal with cryptocurrencies. All financial institutions that want to trade in cryptocurrencies must inform the Fed in advance. All transactions must be legally compliant and protect the consumer. The availability of risk management systems is important, it said. These are intended to ensure that the assets do not violate consumer protection due to their volatility. [Mehr bei Handelsblatt]

Amazon accuses the FTC of “bullying” CEO Jeff Bezos and CEO Andy Jassy. The FTC asked Bezos and Jassy to testify in its investigation into the company’s Prime subscription business. The FTC is investigating whether the process by which users register or cancel their Prime subscriptions could be misleading. Business Insider pointed to internal documents in March. These showed that “since at least 2017, the company has been concerned that user interface designs on Amazon.com are causing customers to feel manipulated into subscribing to Prime.” [Mehr bei Wall Street Journal und CNBC]

Ola Electric wants to bring a fully electric vehicle onto the market in 2024. According to the Indian electric car manufacturer, the new model can accelerate from 0 to 100 kilometers per hour in four seconds and have a range of over 500 kilometers per charge. Ola Electric is a subsidiary of the ride-hailing service that was founded in 2011 Ola. Both Ola and Ola Electric were backed by the Japanese tech investor Softbank co-financed. India, which is on course to become the world’s most populous country next year, is a relatively untapped market when it comes to electric cars. [Mehr bei CNBC]

Meituans shares fell 9 percent on Tuesday after agency Reuters reported that Tencent plans to sell most of its $24 billion stake in the company. The Chinese tech group Tencent currently holds 17 percent of the Chinese food supplier. Tencent is said to want to appease the domestic regulators with a share sale. [Mehr bei Reuters, Wall Street Journal und CNBC]

Celsius, the bankrupt crypto lender, is considering funding proposals to keep the company afloat, according to a media report. The company is said to already have offers to finance the restructuring process. A lawyer representing the Florida-based company said a number of other offers are also expected. [Mehr bei Bloomberg]

Our reading tip on Gründerszene: A Bundeswehr officer wants to build small robots to support his comrades in battle. What Marc Wietfeld told in the start-up scene talk, sounds like an action film. [Mehr bei Gründerszene]

Don’t want to miss anything? Then subscribe to our Gründerszene newsletter! It appears every morning at 8:30 a.m. and brings you all the important news straight to your inbox.

Happy Wednesday!

Your Gründerszene editors

Source: https://www.businessinsider.de/gruenderszene/business/investition-adam-neumann-medien-kritisieren-gruenderkult/