The Deutsche Telekom subsidiary puts 1.35 billion euros on the table for this. Also: Stripe halves its valuation after financing round and VW announces small electric cars.

Good morning! While you slept, work continued elsewhere in the digital scene.

The top topics:

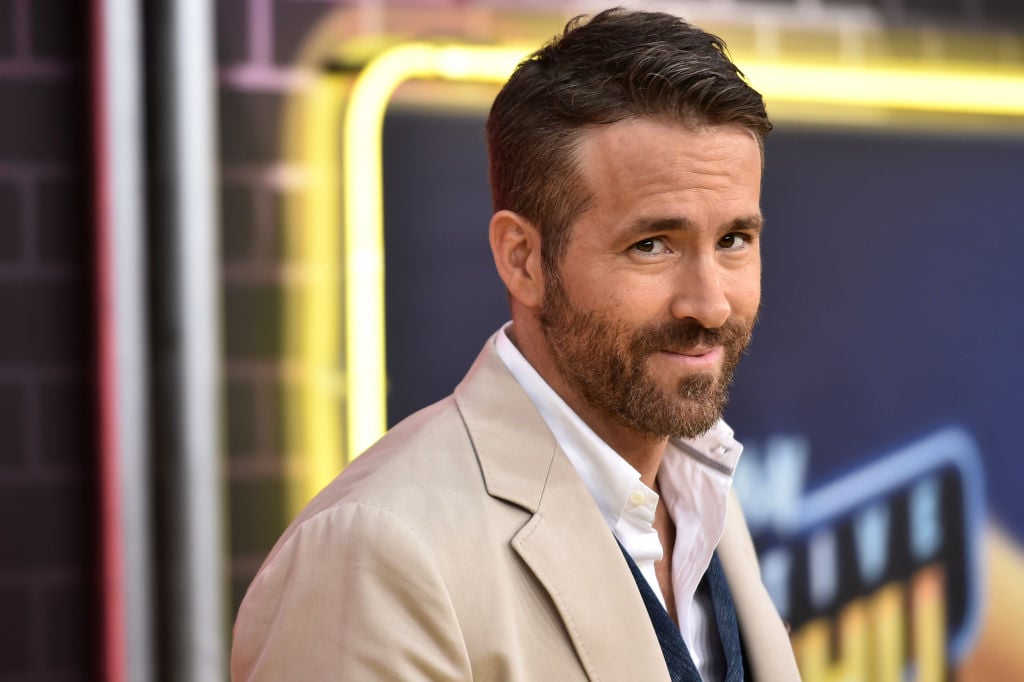

T-Mobile takes over the US competitor Mint Mobile, which also features actor Ryan Reynolds. The US subsidiary of Deutsche Telekom puts 1.35 billion US dollars on the table for this. Mint offers prepaid plans. Experts anticipate strong growth in this segment due to high inflation. The takeover of Ka’ena Corporationthe parent company of Mint Mobile, also includes international calling service Ultra Mobile and the mobile phone wholesaler Plum. T-Mobile announced that the final purchase price depends on Ka’ena’s business development.

The transaction marks T-Mobile’s largest acquisition since the merger Sprint The purchase should not have any impact on the outlook for 2023, but it will have a slightly positive effect on operating profit and cash flow, it said. The news was well received on the stock exchange: T-Mobile shares climbed 0.7 percent in New York. Deutsche Telekom shares listed in the Dax rose to EUR 21.95 at times, reaching their highest level in almost 22 years. [Mehr bei Handelsblatt, Bloomberg, Wall Street Journal und Techcrunch]

On the founding scene: For months, our editor Sarah Heuberger researched, worked out scripts and set the music to music – now her project is finished. Founder scene starts the new Investigativ-Podcast „Cashburners: die Gorillas-Story“. What went wrong on the way up the delivery service startup? How could it be worth so much money so quickly? And how does the founder tick, who is just as polarizing as his company itself? From today you can find out in a new episode every Thursday – wherever there are podcasts. [Mehr bei Gründerszene]

And here are the other headlines of the night:

Stripe has raised $6.5 billion in a funding round led by existing and new investors. The payment processor was valued at just $50 billion, down nearly 50 percent from two years ago. About $3.5 billion of the newly raised capital will be used to cover a tax bill and the rest to buy stock from employees, according to a person familiar with the matter. [Mehr bei Axios, CNBC, The Information, Techcrunch und Reuters]

Volkswagen expands its ID series with a small car. The electric ID.2 will be the size of a Polo and will be produced in Spain. The purchase price should be less than 25,000 euros and the market launch should take place in 2025. According to brand boss Thomas Schäfer, the design and technology of the ID.2 indicate “where Volkswagen is headed overall”. After the production and delivery backlog in 2022, the group wants to deliver more cars to customers again. [Mehr bei Handelsblatt und Reuters]

The shares of Adobe have increased by almost five percent. Earlier, the cloud software provider reported that revenue for the three months ended January 31 rose 9.2 percent from the year-ago quarter to nearly $4.7 billion. The company is also raising its earnings per share guidance for the fiscal year to between $10.85 and $11.15. [Mehr bei CNBC und The Information]

investment: Adept, a Californian artificial intelligence (AI) startup, has raised $350 million in a Series B. The round was led by General Catalyst and Spark Capital. The startup is valued at $1 billion. Adept examines how humans use computers to create an AI model that can convert a text command into a series of actions. [Mehr bei Forbes, Techcrunch]

takeover: Blablacar based in Paris has announced the French ridesharing service Klaxit to take over. Blablacar has its own commuter service called Blablacar Daily. Klaxit will add this service after the acquisition is complete. The details of the deal were not disclosed. [Mehr bei Techcrunch]

Our reading tip on Gründerszene: The Berlin startup Medwing has collected another eight-figure investment. The founders want to use the money to break even. [Mehr bei Gründerszene]

Don’t want to miss anything? Then subscribe to our Gründerszene newsletter! It appears every morning at 8:30 a.m. and brings you all the important news straight to your inbox.

A nice Thursday!

Your Gründerszene editors

Source: https://www.businessinsider.de/gruenderszene/t-mobile-kauft-den-prepaid-konkurrenten-mint-mobile/