This puts OpenAI's valuation higher than that of many S&P 500 companies, including Goldman Sachs, Uber and BlackRock. OpenAI also wants to raise additional capital.

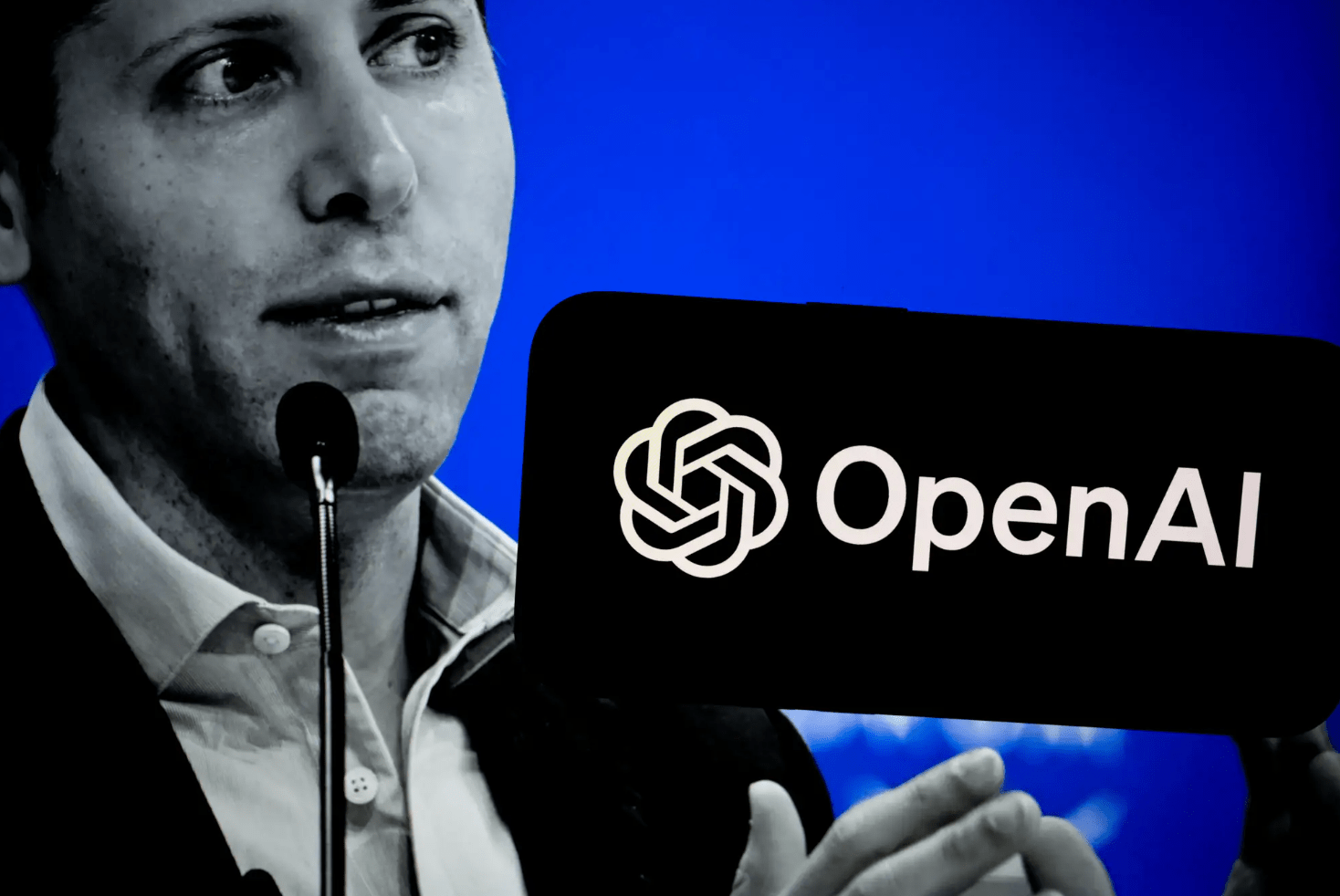

OpenAI is reportedly raising capital at a valuation of $150 billion, more than the market capitalization of over 88 percent of S&P 500 firms – including Goldman Sachs, Uber and BlackRock. The startup is in talks to raise $6.5 billion from various investors, Bloomberg reported on Thursday, citing people familiar with the matter.

Read also

The valuation does not include the amount being invested. OpenAI is also seeking to raise $5 billion in debt, Bloomberg reported. The new valuation makes the startup one of the most valuable in the world – and it's a big jump from the company's previous valuation of $86 billion. That figure was calculated when the company allowed its employees to start selling shares in the company in February.

The money will be used for computing power and other operating costs

The funding round is led by Josh Kushner's Thrive Capital, a New York-based venture firm known for its early investments in startups such as Instagram, Stripe, Robinhood, Spotify and Slack. Microsoft, which has been a partner since 2019, Apple and even Nvidia have also talked about investing in the ChatGPT maker.

Read also

Despite being a startup with an unconventional structure — a nonprofit working alongside a for-profit arm — OpenAI has already proven itself to be a leader in the field of artificial intelligence, and that's in a growing field of well-funded competitors trying to capitalize on the technology. In a memo sent to employees last month, OpenAI's chief financial officer Sarah Friar wrote that the money raised would be used for computing power and other operating costs. According to Bloomberg, the memo also mentioned that the startup plans to allow employees to sell some of their shares in a tender offer later this year.

OpenAI is not the only company with such a rating

A tender offer gives employees of private companies the opportunity to sell a certain number of shares at a fixed price within a limited period of time. This is especially common with startups like OpenAI, which choose to remain private so that employees cannot cash in immediately through an IPO. OpenAI joins a handful of other private companies that are valued far above most publicly traded companies.

Elon Musk's SpaceX was valued at nearly $210 billion in June after it sold its insider shares in a tender offer for $112. Other large private companies include TikTok parent ByteDance, valued at $286 billion late last year, and Stripe, valued at $70 billion in July. OpenAI did not immediately respond to a request for comment.

Read the original article on Business Insider.

Read also

Source: https://www.businessinsider.de/gruenderszene/technologie/openai-wird-berichten-zufolge-mit-150-milliarden-dollar-bewertet/