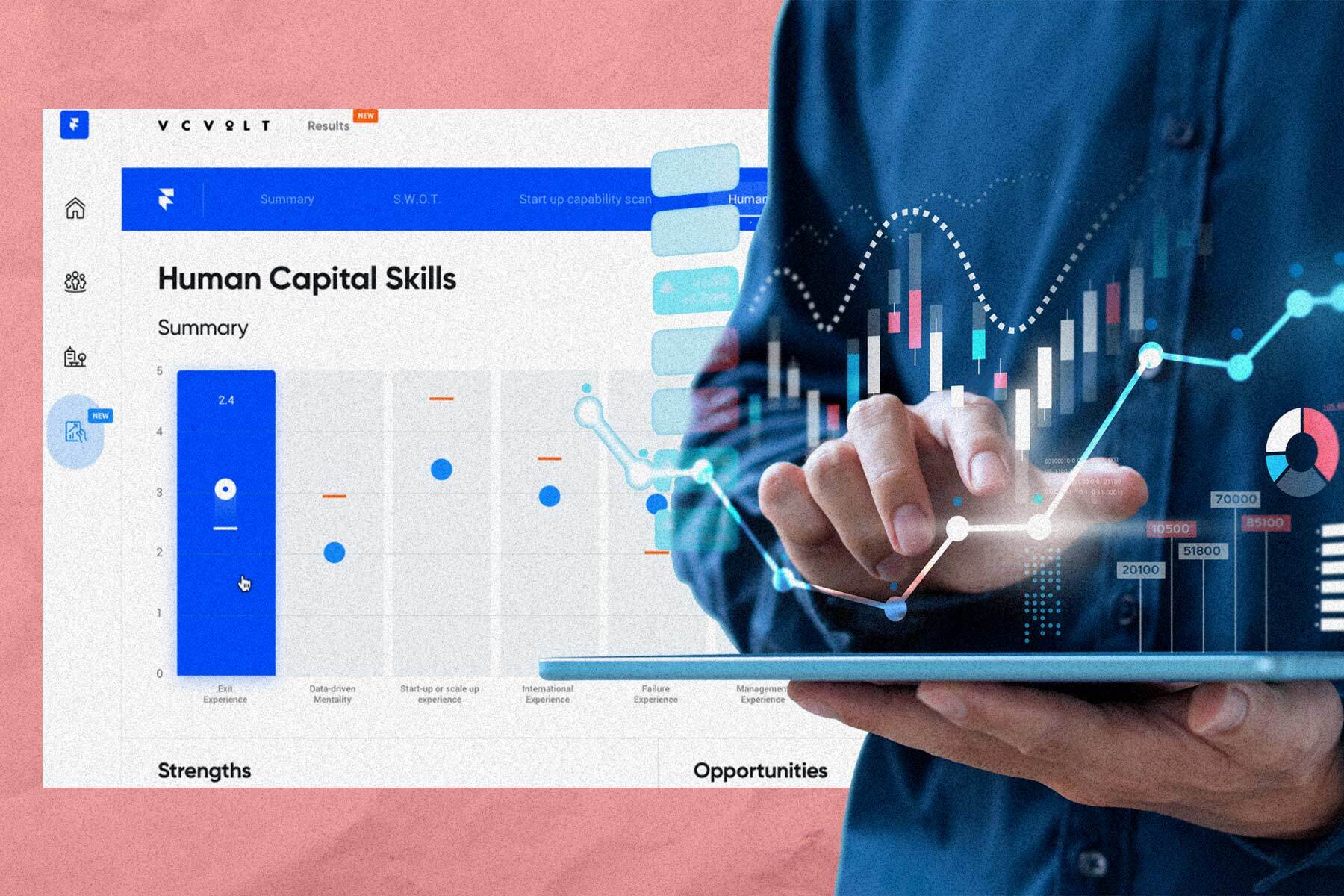

Figures, data, facts – the basis of almost every investment decision. Gartner predicts that by 2025, over 75 percent of early-stage investors will make their decisions based on data. Nevertheless, many investors still rely on their gut feeling when assessing founders and teams. Is the chemistry right? Is the vibe there? Janneke Niessen, co-founder of the Dutch venture capital firm Capital T, believes that investors should also rely on data when evaluating teams instead of just listening to their gut feeling. Together with Eva de Mol, also co-founder of Capital T and doctoral student at the renowned elite university UC Berkeley, she developed VC-Volt. In her dissertation, de Mol examined what makes successful teams and published her findings in the Harvard Business Review. This research formed the basis for VC-Volt, a computer-based model that analyzes and evaluates startup teams using a questionnaire. Niessen and her team use this tool in every investment decision made by Capital T.

Why is it important to analyze a team using data?

When Niessen makes investment decisions, the team is the most important thing for her. Before the business model, product and traction. “A common reason why startups don't make it is because the team gives up or the founders fall out,” says Niessen. A lot is demanded of the employees in order to build a successful company. Hard work, determination and adaptability. “If a startup doesn't have a product-market fit, then a good team will be able to adapt and achieve product-market fit,” says Niessen.

Source: https://www.businessinsider.de/gruenderszene/business/bauchgefuehl-reicht-nicht-wie-dieser-vc-gruender-anhand-von-daten-bewertet/