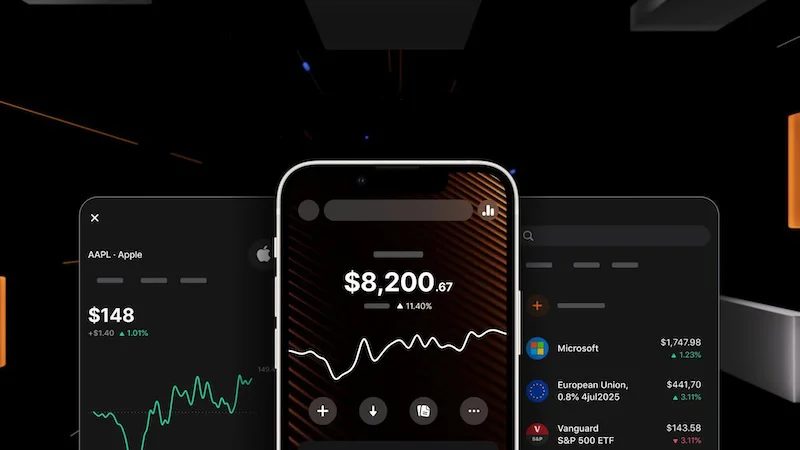

The British neobank Revolut has launched its own trading app: Revolut Invest. It is intended to give private customers access to over 5,000 assets – including stocks, bonds and ETFs.

Revolut, one of the most valuable fintech companies in Europe, is launching its own trading app called “Revolut Invest”. This is according to a report by the news agency Bloomberg citing an interview with Rolandas Juteika, Head of Wealth and Trading at Revolut.

According to the report, the company wants to completely spin off its asset management offering, currently valued at 8.5 billion euros. The goal: Revolut wants to compete with neobrokers such as Robinhood, Bitpanda, Trade Republic and Scalable Capital with its new app.

Revolut Invest: When will the trading app come to Germany?

Revolut Invest will include around 5,000 assets at its debut, including US and European stocks, ETFs and bonds. For investments in stocks and bonds, Bloomberg a flat fee of one euro or 0.25 percent will be charged.

This would put Revolut Invest on a par with the German neobrokers Trade Republic and Scalable Capital. However, the app is currently still in the test phase. Private investors in Greece, Denmark and the Czech Republic can already use it. If the test phase is successful, Revolut Invest will then be introduced in other countries in the European Economic Area at the end of 2024 – reportedly also in Germany.

According to Rolandas Juteika, Revolut wants to double the number of assets available for trading by then. The company's goal is to attract private investors in particular with the trading app. The competition is fierce, but Revolut has already made a name for itself as a neobank. This could help the company gain a foothold as a neobroker.

Premium subscription with higher limits

Revolut already allows small investors to trade stocks and other assets via its banking app. With Revolut Invest, however, the company primarily wants to attract private investors who do not have an account with the neobank and thus acquire new customers.

The new trading app will also include a premium subscription called “Trading Pro.” It will reduce commission fees, allow higher limits, and provide access to analytics. According to Juteika, anyone who wants to sign up for Revolut Invest will have to go through the same process as opening a Revolut bank account.

In concrete terms: Revolut Invest users can theoretically use all the functions of the banking app if they download it. Bank customers, in turn, should continue to have the option of making investments via the banking app.

Also interesting:

Source: https://www.basicthinking.de/blog/2024/09/26/neue-trading-app-revolut-invest-bald-auch-in-deutschland/